Disseminated on behalf of Ucore Rare Metals Inc., may include paid advertisements.

Investment Considerations

- The company is closely aligned with national policy, receiving funding from both the U.S. Department of Defense ($18.4 million) and Natural Resources Canada (C$4.3 million).

- Ucore’s RapidSX™ platform promises to deliver faster REE separation than traditional SX and is being commercialized at scale.

- The Louisiana SMC aims to ramp to 7,500 TPA rare earth oxide production and benefits from FTZ status, DoD funding, and private equity backing.

- Ucore’s 100%-owned Bokan-Dotson Ridge project remains a potentially valuable strategic heavy REE resource supported by a $145M AIDEA bond.

- As China imposes REE export restrictions and the U.S. escalates domestic production policy, Ucore is positioned as a secure Western alternative.

Ucore Rare Metals Inc. (TSX.V: UCU) (OTCQX: UURAF) is a critical metals technology company developing scalable rare earth element (“REE”) refining infrastructure in North America. Originally founded in 2006 as a mineral exploration company, Ucore has since evolved into a processing technology innovator focused on commercializing its proprietary RapidSX™ platform under a $18.4 million contract from the U.S. Department of Defense, with additional support from Natural Resources Canada. The company’s flagship deployment is the Louisiana Strategic Metals Complex (“SMC”), with additional SMCs planned to follow.

Ucore’s mission is to help reestablish a domestic REE supply chain by offering competitive, modular processing solutions that reduce dependence on China. Supported by government funding, private capital, and engineering partnerships, Ucore aims to meet growing demand for rare earth oxides in electric vehicles, defense systems, and advanced energy technologies.

The company is headquartered in Halifax, Nova Scotia.

Ucore is working to scale Western supply needs by establishing REE separation and rare earth oxide (“REO”) production capabilities in cooperation with strategic upstream supply and downstream offtake partnerships. The company, along with its industry partners, aims to unlock access to Western REEs for current consumer, energy, manufacturing and military sectors.

By 2025, Ucore expects to commercially separate U.S.-friendly sources of REEs and supply OEMs with REOs required to produce rare earth permanent magnets (“REPMs”) – the essential component of electric motors and generators required to support the world’s transition to electrification and sustainable energy sources.

The company intends to contribute to this initiative through the near-term development of a heavy and light rare-earth processing facility in Louisiana and subsequent development of Strategic Metals Complexes (SMCs) in Alaska and Canada, as well as through the longer-term development of its 100%-owned Heavy Rare Earth Element (HREE) mineral resource property at Bokan Mountain on Prince of Wales Island, Alaska.

Ucore is headquartered in Halifax, Nova Scotia.

Projects & Technology

RapidSX™ Separation Technology

RapidSX™ is Ucore’s proprietary rare earth separation platform, delivering three times faster processing than traditional solvent extraction (SX) methods. Its current demonstration program in Kingston, Ontario, is being conducted under contract with the U.S. Department of Defense to prove commercial readiness for processing both heavy and light REEs. The project is also supported by Natural Resources Canada.

RapidSX™ employs a column-based design that eliminates the need for powered mixer-settlers, enabling a smaller facility footprint, quicker commissioning, and lower CAPEX and OPEX. The platform is adaptable to light and heavy REE feedstocks and is structured for modular scale-up.

The 52-stage RapidSX™ Commercial Demonstration Plant in Kingston, Ontario—operated in partnership with Kingston Process Metallurgy—has logged thousands of runtime hours and is currently processing rare earth feedstock further to the company’s U.S. Department of Defense contract. In January 2025, Ucore secured a $500,000 non-dilutive grant from Ontario’s Critical Minerals Innovation Fund to support the advancement of the Kingston facility and, in the words of Ontario Mines Minister George Pirie, “build a secure supply chain ready to fuel the technologies of tomorrow.”

Strategic Metals Complex – Louisiana

Ucore has selected an 80,800-square-foot brownfield site within the England Airpark in Alexandria, Louisiana, as the location for its first commercial rare earth refining facility. The Louisiana SMC is expected to scale from 2,000 tonnes per annum (TPA) of total rare earth oxides initially to 5,000 TPA, with potential to ultimately reach 7,500 TPA.

The facility benefits from Foreign Trade Zone (FTZ) status, reducing tariff burdens on imported inputs and enhancing logistics efficiency. In addition to these structural advantages, the state of Louisiana has outlined an incentive package valued at $15 million, including a $900,000 infrastructure grant and $360,000 in additional local support. The project is expected to create 100 family-wage jobs and has received strong support from federal and state officials.

To date, Ucore has secured $2.3 million in milestone payments under its $18.4 million OTA award from the U.S. Department of Defense. In early 2024, the company also secured C$2.16 million in private investment from Hondo Private Equity to support its commercialization efforts.

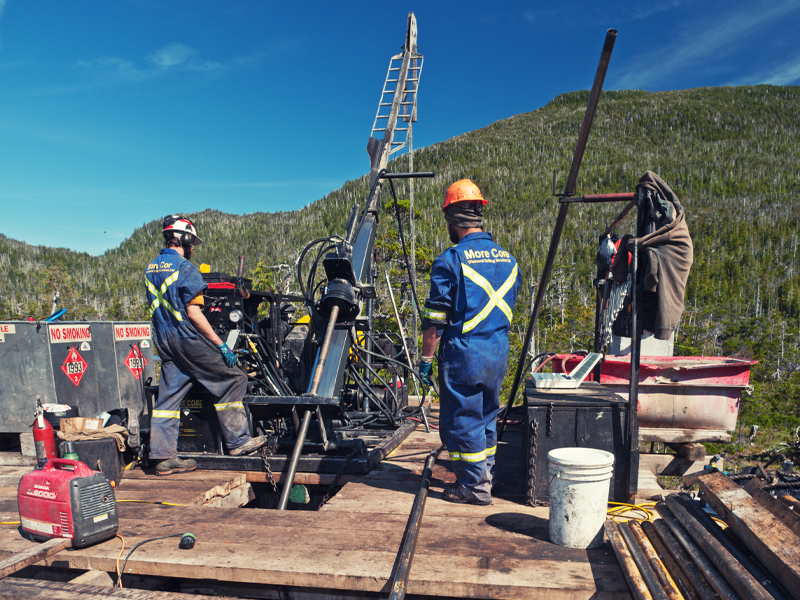

Bokan-Dotson Ridge REE Project – Alaska

Ucore maintains 100% ownership of the Bokan-Dotson Ridge heavy REE project in Southeast Alaska. A Preliminary Economic Assessment was completed in January 2013. The Alaska Industrial Development and Export Authority (AIDEA) has authorized $145 million in bond financing under SB99 (2014) to support future development.

While Bokan remains a long-term asset, Ucore continues to advance it at a measured pace, complementing its near-term focus on commercial rare earth refining and oxide production at the Louisiana SMC.

Market Opportunity

According to Grand View Research, the global rare earth elements market was estimated at $3.95 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 8.6% from 2025 to 2030. The market outlook remains strong, fueled by the growing demand for permanent magnets and catalysts in the automotive sector.

In March 2025, President Trump invoked the Defense Production Act to prioritize domestic critical mineral production, signaling a national mandate to reduce reliance on “hostile foreign powers’ mineral production.” One month later, the Chinese government enacted immediate export restrictions on seven key rare earth elements, including dysprosium and terbium, further intensifying pressure on Western nations to develop secure and independent supply chains. This underscores the strategic value of Ucore’s domestic separation infrastructure.

Leadership Team

Pat Ryan, P.Eng., Chairman and CEO, is the founder of Neocon International, a leading automotive OEM supplier. He brings over 25 years of experience in global supply chain innovation and has led Ucore since 2014 in its strategic pivot toward rare earth processing.

Peter Manuel, Vice President, CFO & Corporate Secretary, has served as Ucore’s financial lead for 14 years. Trained as a Chartered Accountant, with extensive experience across Canada, England, and Ireland, Mr. Manuel has advised public and private entities on strategic planning, treasury, and assurance.

Michael Schrider, MEng, P.E., Vice President & COO, is a multidisciplinary engineer with over 30 years of experience. He founded and operated engineering firms SAi and ABD and has overseen all phases of Ucore’s technical development since 2016.

Geoff Atkins, Vice President of Business Development, has 30 years of mining experience and was instrumental in advancing both Lynas’ Mt. Weld and Vital Metals’ Nechalacho REE operations. He brings deep operational knowledge and leads feedstock strategy at Ucore.